JPMorgan Chase and Co. cut its holdings in Microchip Technology Incorporated (NASDAQ: MCHP) by 87.5% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund owned 6,461,925 shares of the semiconductor company's stock after selling 45,221,613 shares during the period. JPMorgan Chase and Co. owned

NEOS Investment Management LLC raised its position in Microchip Technology Incorporated (NASDAQ: MCHP) by 68.1% during the undefined quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 244,937 shares of the semiconductor company's stock after purchasing an additional 99,204 shares during the quarter. NEOS Investment

First National Bank of Omaha acquired a new position in shares of Microchip Technology Incorporated (NASDAQ: MCHP) during the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor acquired 56,518 shares of the semiconductor company's stock, valued at approximately $3,630,000. A number

Microchip Technology (NASDAQ: MCHP) executives said the company is seeing signs of strengthening demand and a more normalized channel environment, while reiterating that near-term financial priorities have shifted toward debt reduction following the recent downturn. Channel normalization and improving demand indicators Matthias Kaestner, corporate vice president of Auto, Data Center, and Networking at Microchip, said the

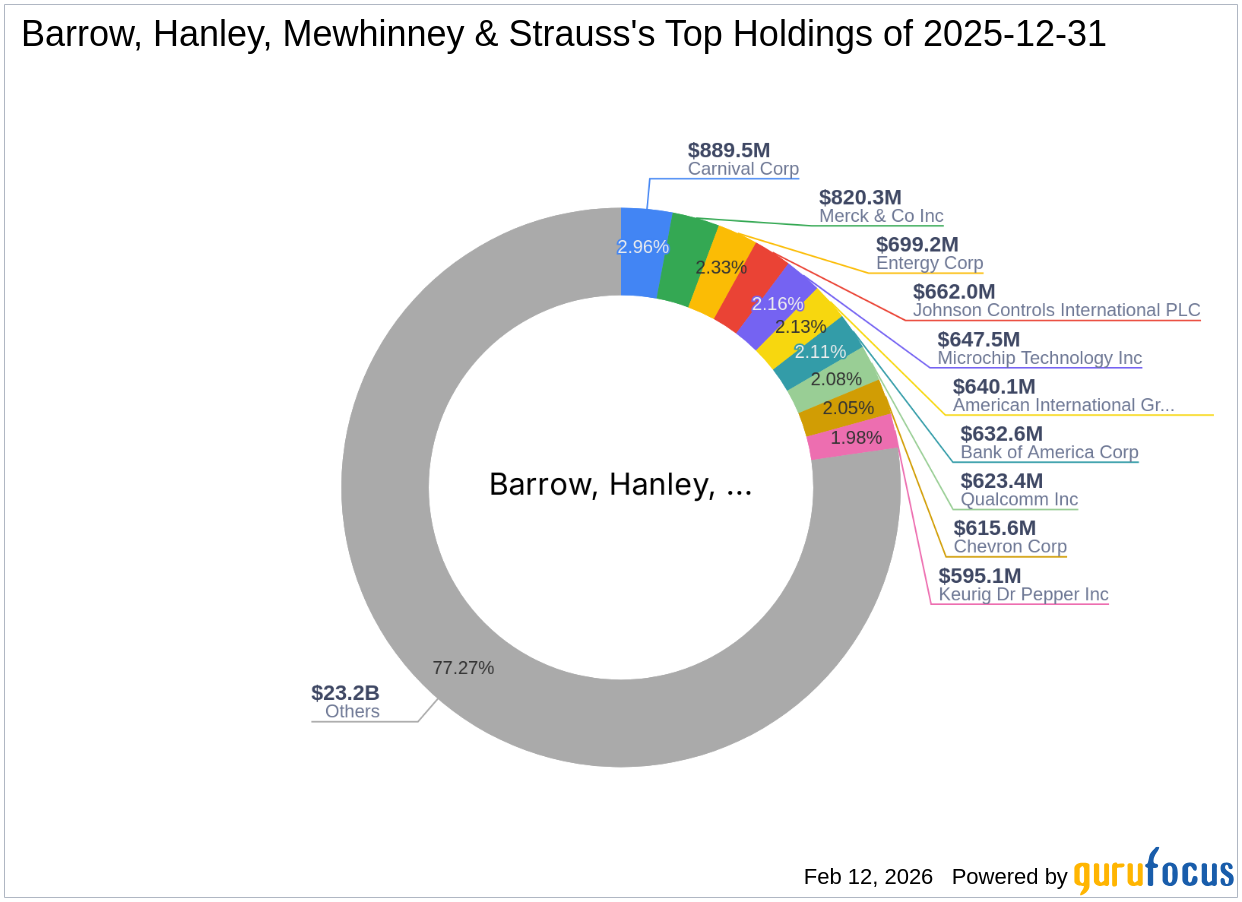

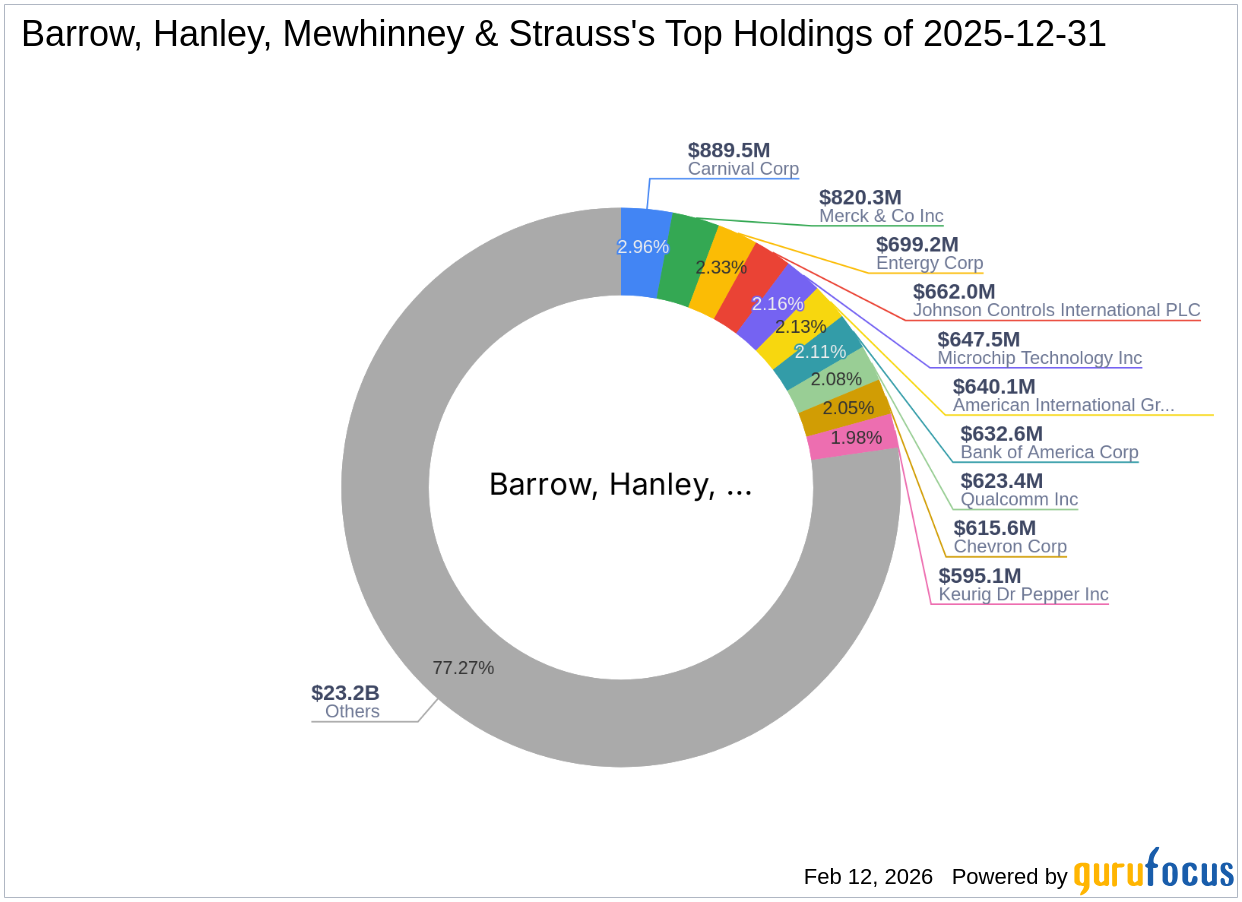

Insight into the Fourth Quarter 2025 13F Filing Barrow, Hanley, Mewhinney and Strauss (Trades, Portfolio) recently submitted their 13F filing for the fourth quar

Microchip Technology Incorporated (MCHP) Presents at Wolfe Research Auto, Auto Tech and Semiconductor Conference 2026 Transcript

Company simplifies and accelerates edge AI system development with silicon, software, tools, production-ready applications and support from a growing partner ecosystem Company simplifies and accelerates edge AI system development with silicon, software, tools, production-ready applications and support from a growing partner ecosystem

Oppenheimer Asset Management Inc. decreased its stake in Microchip Technology Incorporated (NASDAQ: MCHP) by 22.7% during the undefined quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm owned 233,518 shares of the semiconductor company's stock after selling 68,508 shares during the quarter. Oppenheimer Asset

Microchip Technology is showing signs of recovery with broad-based revenue growth and gross margin exceeding 60% for the first time since Q4 2024. MCHP's inventory days remain elevated at 201, limiting operating leverage and raising the risk of further inventory-related charges despite improving demand signals. Valuation is stretched at 30x one-year forward PE, already pricing in a full recovery, which caps upside and compresses risk/reward.

CHANDLER, Ariz., Feb. 09, 2026 (GLOBE NEWSWIRE) -- (NASDAQ:MCHP) – Microchip Technology Incorporated, a leading provider of smart, connected, and secure embedded control solutions, today announced that the Company will present at the Wolfe Research Auto, Auto Tech, and Semiconductor Conference on Wednesday, February 11, 2026 at 10:20 a.m. (Eastern Time). Presenting for the Company will be Mr. Sajid Daudi, Head of Investor Relations. A live webcast of the presentation will be made available by Wolfe, and can be accessed on the Microchip website at www.microchip.com.