PPG Industries, Inc. (NYSE: PPG - Get Free Report) CFO Vincent Morales sold 78,095 shares of the firm's stock in a transaction on Friday, February 13th. The shares were sold at an average price of $131.00, for a total transaction of $10,230,445.00. The transaction was disclosed in a filing with the Securities and Exchange Commission, which

PPG Industries (NYSE: PPG - Get Free Report) and Toray Industries (OTCMKTS:TRYIY - Get Free Report) are both large-cap basic materials companies, but which is the better investment? We will contrast the two companies based on the strength of their institutional ownership, dividends, earnings, risk, analyst recommendations, valuation and profitability. Analyst Recommendations This is a summary

PITTSBURGH--(BUSINESS WIRE)--PPG (NYSE:PPG) and the PPG Foundation today announced an investment of $18.1 million in communities worldwide in 2025. The 2025 funding supported more than 400 community partners and programs that focus on advancing education, delivering community sustainability and encouraging PPG employee volunteerism. “In 2025, our targeted investments and partnerships expanded STEM education, accelerated career training and skills development and helped protect and beautify neig.

Shares of PPG Industries, Inc. (NYSE: PPG - Get Free Report) have earned a consensus recommendation of "Hold" from the nineteen ratings firms that are covering the company, Marketbeat reports. Eleven analysts have rated the stock with a hold rating, seven have issued a buy rating and one has given a strong buy rating to the

BI Asset Management Fondsmaeglerselskab A S lessened its stake in shares of PPG Industries, Inc. (NYSE: PPG) by 62.1% in the third quarter, according to its most recent filing with the SEC. The fund owned 8,841 shares of the specialty chemicals company's stock after selling 14,516 shares during the period. BI Asset Management

Principal Financial Group Inc. lessened its position in PPG Industries, Inc. (NYSE: PPG) by 1.6% in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 260,713 shares of the specialty chemicals company's stock after selling 4,285 shares during the

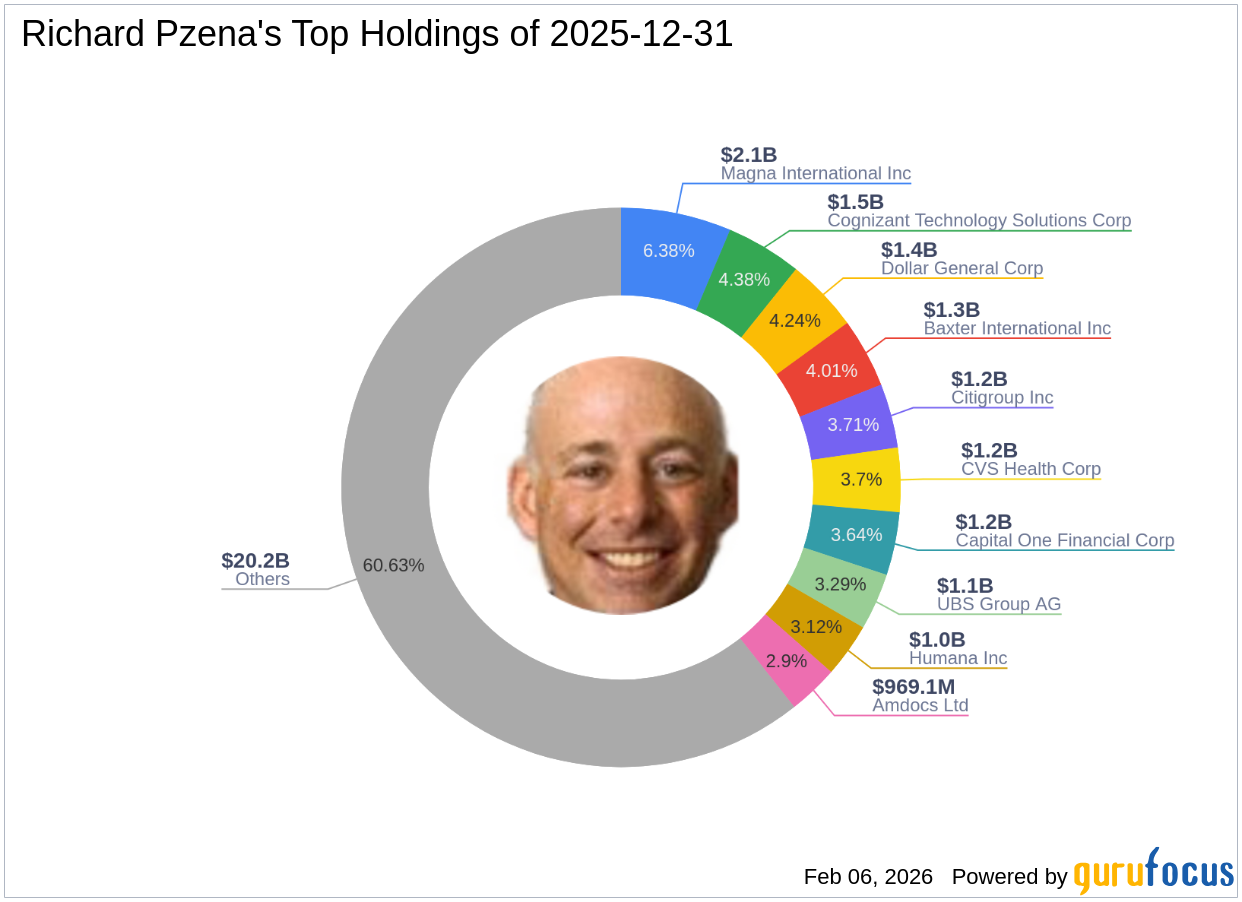

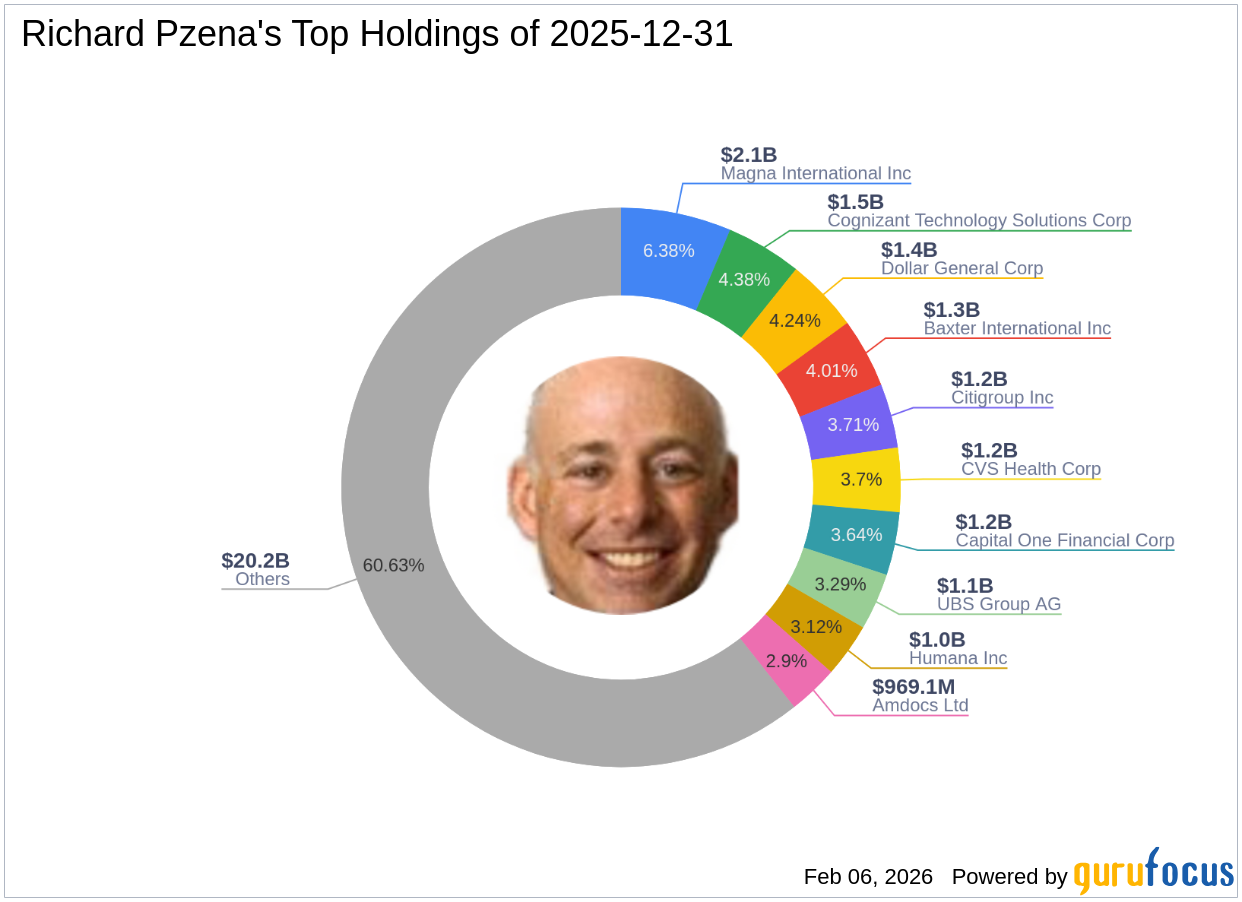

Insights from the Fourth Quarter 2025 13F Filing Richard Pzena (Trades, Portfolio) recently submitted the 13F filing for the fourth quarter of 2025, providing

PPG Industries launches STEELGUARD 652 in North America, a water-based intumescent coating, delivering up to two hours of fire protection for structural steel.

PPG Industries is a high-quality coatings leader, trading at a discounted 14.4x forward P/E. PPG's market share gains, pricing power, and AI-driven product innovation underpin medium-term growth, especially in aerospace and architectural coatings. PPG's strong BBB+ balance sheet, 53-year dividend growth streak, and active buybacks support a continued ‘Buy' rating.

FORT LAUDERDALE, Fla.--(BUSINESS WIRE)--PPG (NYSE:PPG) today announced the completion of a COLORFUL COMMUNITIES® project in collaboration with Heart of America to revitalize multiple spaces at the Fort Lauderdale, Fla. campus of Kids in Distress, Inc. (KID), an organization dedicated to preventing child abuse, preserving families and treating children who have been abused and neglected. The Colorful Communities project brought together 100 of PPG's top global leaders to transform foster family.