COLLIERVILLE, Tenn.--(BUSINESS WIRE)--For the sixth consecutive year, Mueller Industries, Inc. (NYSE: MLI) has announced a double digit increase to its quarterly dividend. The Board of Directors has declared a regular quarterly cash dividend of $.35 per share, to be paid on March 27, 2026 to stockholders of record as of the close of business on March 13, 2026. This represents a 40 percent increase over the 2025 quarterly dividend. Mueller Industries, Inc. (NYSE: MLI) is an industrial corporatio.

Cibc World Market Inc. increased its position in shares of Mueller Industries, Inc. (NYSE: MLI) by 22.8% during the undefined quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 46,051 shares of the industrial products company's stock after purchasing an additional 8,545 shares during

Mueller is rated Hold as shares trade near fair value, with a DCF-derived target of $113–118 and limited upside. Q4 revenue exceeded expectations, but EPS missed due to copper price volatility and hedge losses, causing a sharp market correction. MLI's strong 2025 performance—double-digit revenue and EPS growth—was overshadowed by Q4 margin compression and market disappointment.

Principal Financial Group Inc. lowered its position in shares of Mueller Industries, Inc. (NYSE: MLI) by 2.0% in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 245,761 shares of the industrial products company's stock after selling 5,028 shares during

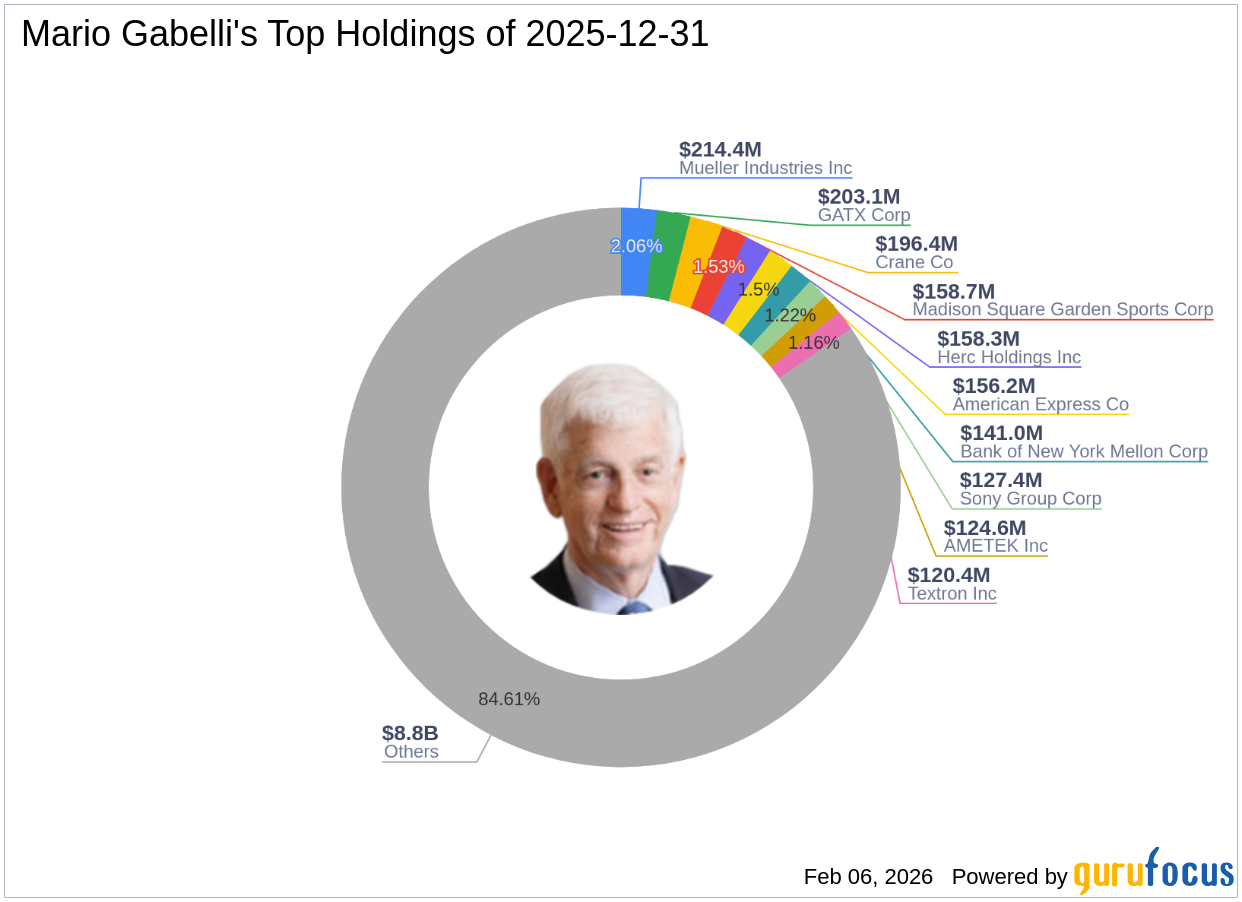

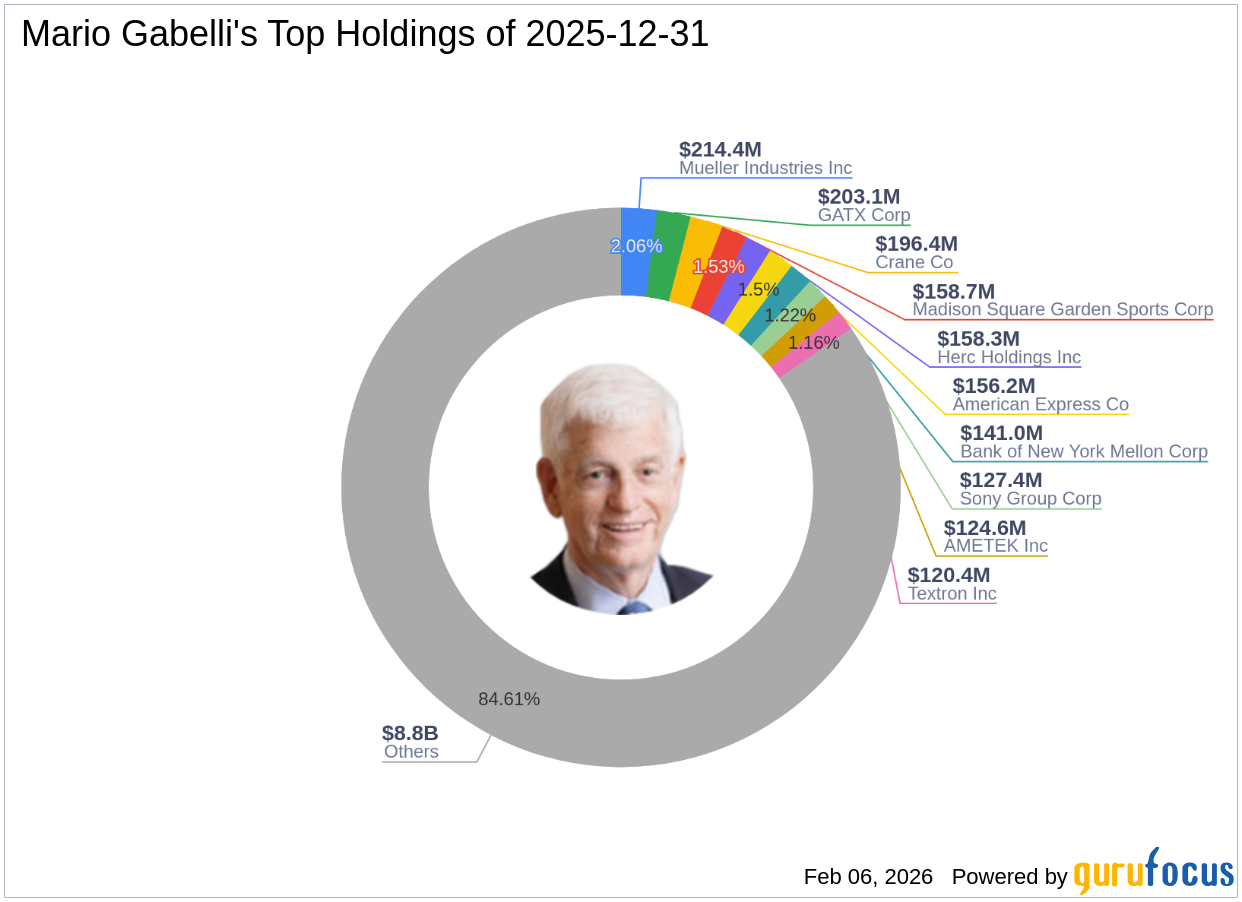

Insights into Mario Gabelli (Trades, Portfolio)'s Investment Moves in Q4 2025 Mario Gabelli (Trades, Portfolio) recently submitted the 13F filing for the fourt

Allianz Asset Management GmbH lowered its position in shares of Mueller Industries, Inc. (NYSE: MLI) by 35.5% during the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm owned 406,705 shares of the industrial products company's stock after selling 223,736 shares during the

COLLIERVILLE, Tenn.--(BUSINESS WIRE)--Mueller Industries, Inc. (NYSE: MLI) today reported fourth quarter and full year results for 2025. For the Fourth Quarter 2025 versus Fourth Quarter 2024: Net sales: $962.4 million vs. $923.5 million, up 4.2%. Operating income: $172.0 million vs. $170.3 million, up 1.0%. Net income: $153.7 million vs. $137.7 million, up 11.6%. Diluted EPS: $1.38 vs. $1.21, up 14.0%. For the Full Year 2025 versus the Full Year 2024: Net sales: $4.2 billion vs. $3.8 billion,.

Ballast Asset Management LP purchased a new stake in shares of Mueller Industries, Inc. (NYSE: MLI) during the undefined quarter, according to its most recent filing with the SEC. The institutional investor purchased 30,239 shares of the industrial products company's stock, valued at approximately $3,057,000. A number of other hedge funds and other

Barlow Wealth Partners Inc. boosted its holdings in shares of Mueller Industries, Inc. (NYSE: MLI) by 1.7% in the undefined quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 299,174 shares of the industrial products company's stock after buying an additional 4,931 shares during

Mueller Industries sits at a crossroads. The company's 26.1% return on equity and 16.2% return on assets represent the kind of numbers that make investors salivate.