In the fourth quarter of 2025, the Baron Discovery Fund returned 0.19% (Institutional Shares), trailing the Russell 2000 Growth Index by 1.03%. In these periods, low quality (high debt and poor profitability) and short-term price momentum-oriented stocks outperformed. Exact Sciences Corporation received a buyout offer in the fourth quarter by Abbott Laboratories (ABT) for a price of $105 in cash.

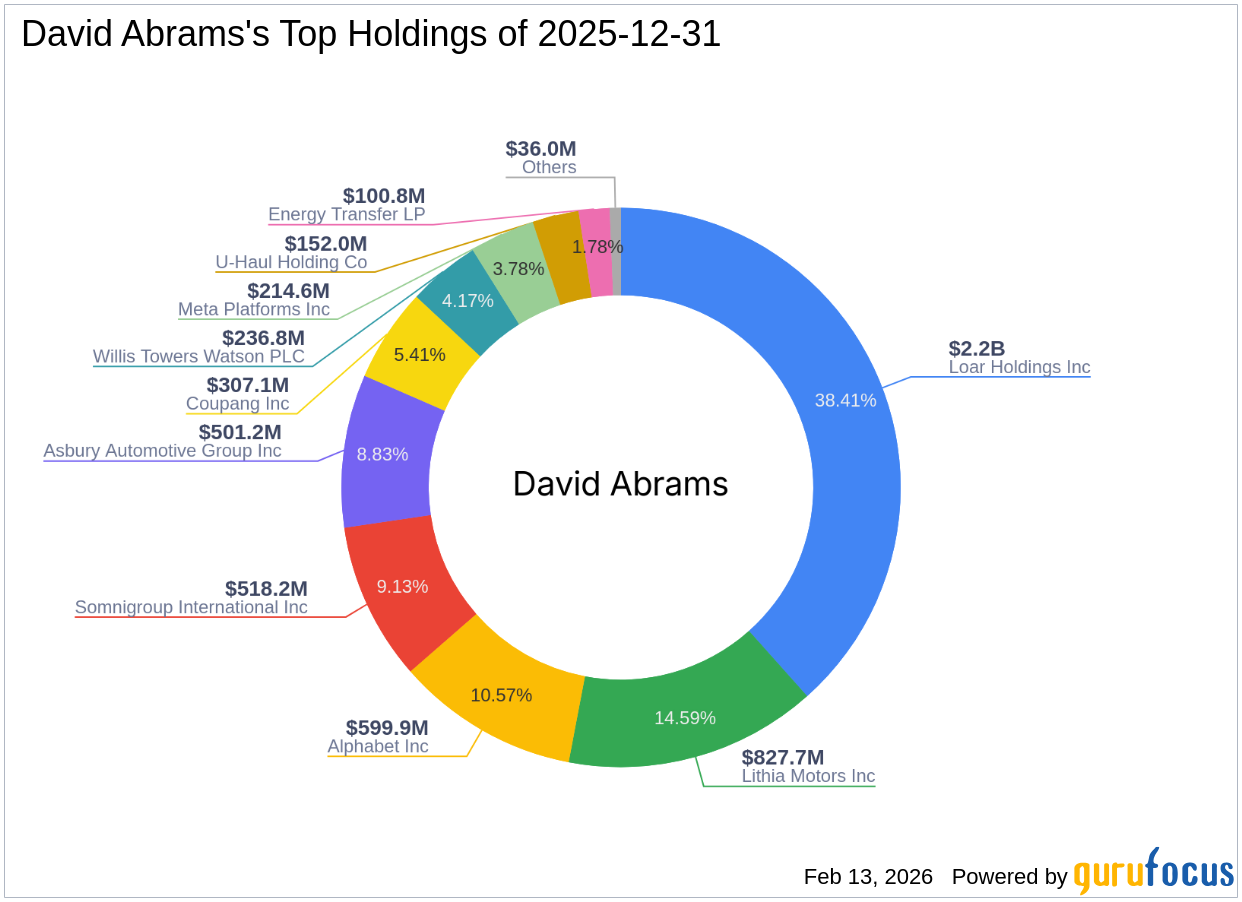

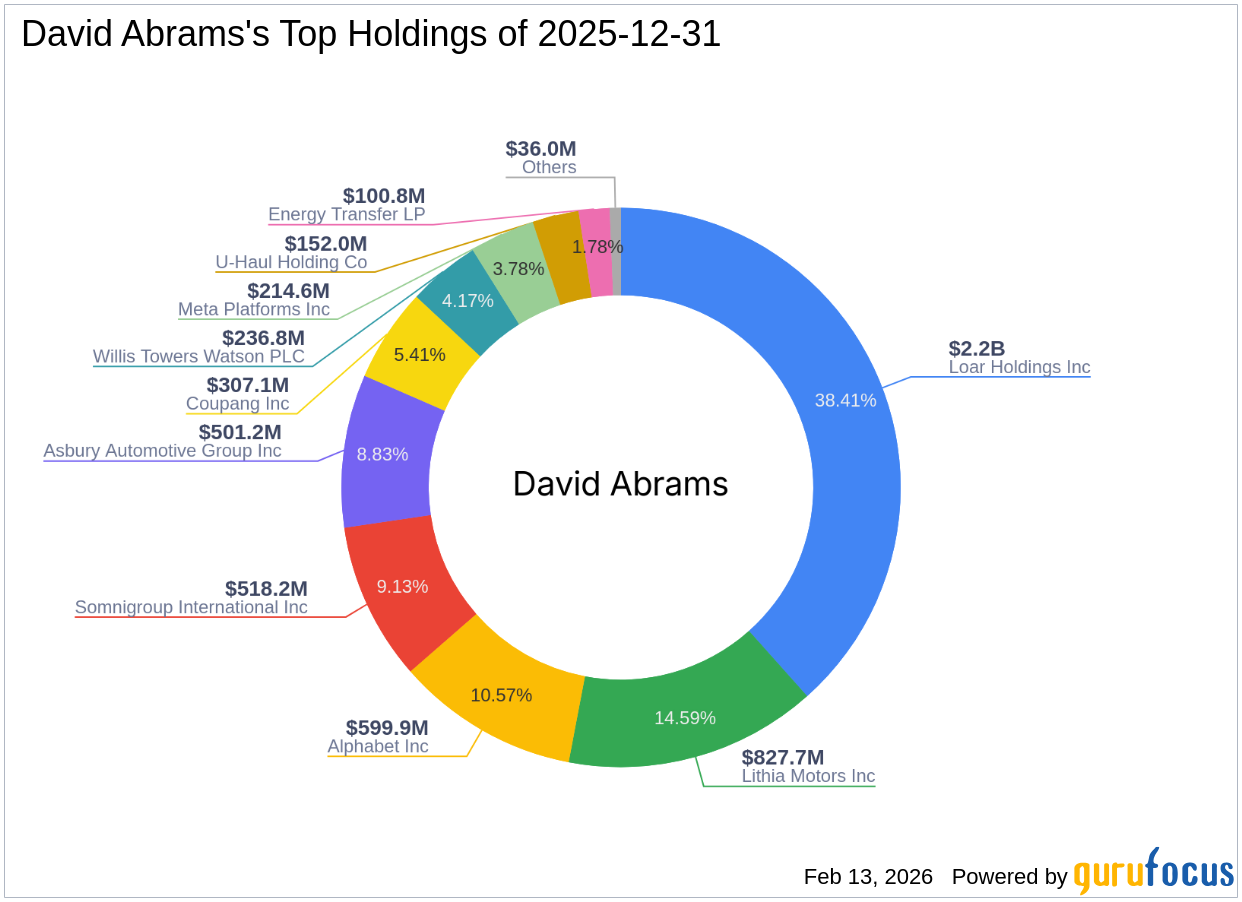

Insight into Abrams Capital Management's Fourth Quarter 2025 Moves David Abrams (Trades, Portfolio) recently submitted the 13F filing for the fourth quarter of

WHITE PLAINS, NEW YORK / ACCESS Newswire / February 12, 2026 / Loar Holdings Inc. (NYSE:LOAR), will report Q4 and Full Year 2025 earnings before the market opens on Thursday, February 26, 2026. A conference call will follow at 10:30a.m.

Loar (NYSE: LOAR - Get Free Report) and Woodward (NASDAQ: WWD - Get Free Report) are both aerospace companies, but which is the superior investment? We will contrast the two companies based on the strength of their profitability, dividends, institutional ownership, earnings, analyst recommendations, valuation and risk. Valuation and Earnings This table compares Loar and Woodward"s gross

WHITE PLAINS, NEW YORK / ACCESS Newswire / January 22, 2026 / Loar Holdings Inc. (NYSE:LOAR) ("Loar") announced today that it has completed the acquisition of Harper Engineering Company ("Harper") for cash consideration of $250 million. Founded in 1968 by O.J.

WHITE PLAINS, NEW YORK / ACCESS Newswire / December 26, 2025 / Loar Holdings Inc. (NYSE:LOAR) ("Loar," "we," "our," or "the Company") today announced the completion of its acquisition of LMB Fans & Motors ("LMB") for €367 million, plus the assumption of debt, paid in cash at closing. Founded more than 60 years ago, LMB is a global leader in designing and manufacturing customized, high-performance fans and motors.

Rocket Lab (NASDAQ: RKLB - Get Free Report) and Loar (NYSE: LOAR - Get Free Report) are both aerospace companies, but which is the superior investment? We will contrast the two companies based on the strength of their valuation, earnings, analyst recommendations, institutional ownership, risk, profitability and dividends. Volatility and Risk Rocket Lab has a beta of

The average of price targets set by Wall Street analysts indicates a potential upside of 29.6% in Loar Holdings Inc. (LOAR). While the effectiveness of this highly sought-after metric is questionable, the positive trend in earnings estimate revisions might translate into an upside in the stock.

Cerity Partners LLC purchased a new position in shares of Loar Holdings Inc. (NYSE: LOAR) during the second quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor purchased 242,354 shares of the company's stock, valued at approximately $20,884,000. Cerity Partners LLC

Optex Systems (NASDAQ: OPXS - Get Free Report) and Loar (NYSE: LOAR - Get Free Report) are both aerospace companies, but which is the better stock? We will compare the two companies based on the strength of their earnings, risk, valuation, profitability, institutional ownership, dividends and analyst recommendations. Analyst Ratings This is a summary of recent ratings