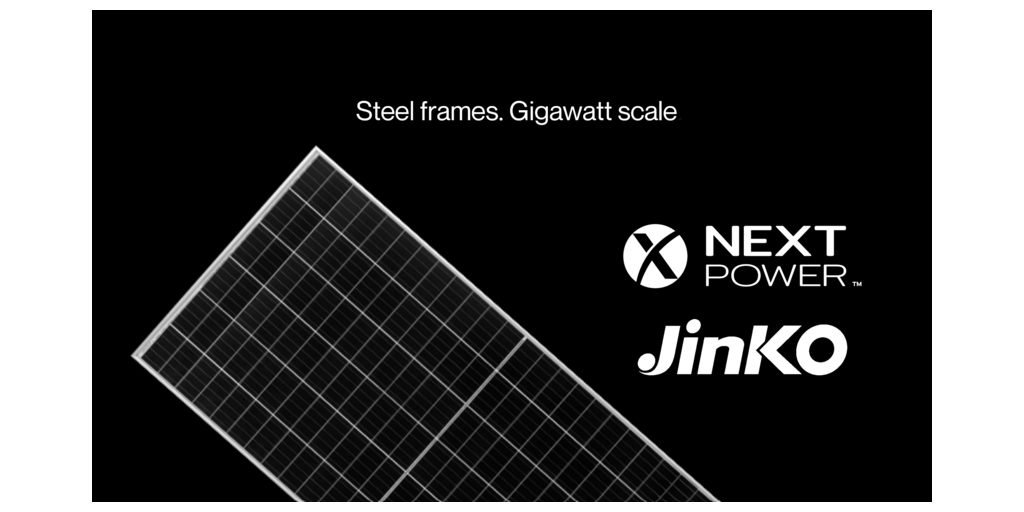

FREMONT, Calif.--(BUSINESS WIRE)--Nextpower™ (NASDAQ: NXT), a leading provider of intelligent power generation technology and solutions for solar power plants, today announced its second major commercial order for U.S.-manufactured steel module frames, entering into a multi-year supply agreement with Jinko Solar (U.S.) Industries Inc. (NYSE: JKS), one of the longest operating solar module manufacturers in the United States. Under the agreement, Nextpower plans to supply more than one gigawatt (.