![Post]()

Shares of Graco Inc. (NYSE: GGG - Get Free Report) have received a consensus rating of "Moderate Buy" from the seven brokerages that are currently covering the firm, MarketBeat.com reports. Three research analysts have rated the stock with a hold rating and four have given a buy rating to the company. The average twelve-month target price

Designed to reduce everyday strain, bring baby closer, and reimagine travel to make it easier, without compromising safety. ATLANTA, Feb. 18, 2026 /PRNewswire/ -- Graco®, America's most trusted baby gear brand*, announced today the launch of the SnugRide® Turn & Slide Rotating Infant Car Seat , the brand's first-ever rotating infant car seat, designed to make one of the most physically demanding and repeated parts of daily life with a newborn significantly easier: getting baby safely in and out of the car.

Mitsubishi Heavy Industries (OTCMKTS:MHVYF - Get Free Report) and Graco (NYSE: GGG - Get Free Report) are both large-cap industrials companies, but which is the superior investment? We will compare the two businesses based on the strength of their profitability, institutional ownership, dividends, risk, analyst recommendations, earnings and valuation. Profitability This table compares Mitsubishi Heavy Industries

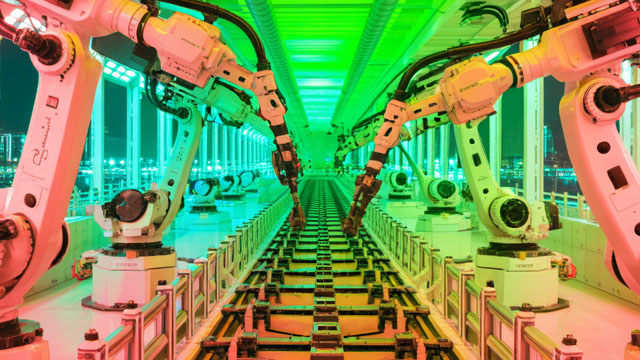

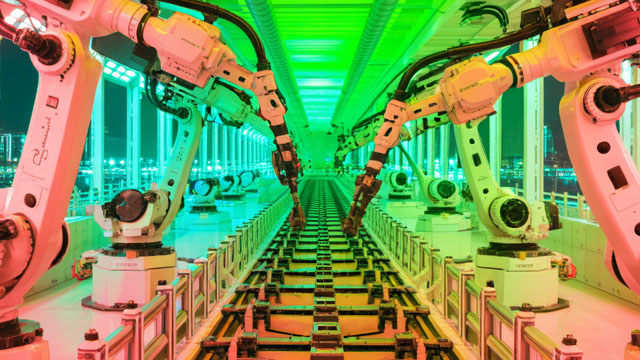

MINNEAPOLIS--(BUSINESS WIRE)--The Board of Directors of Graco Inc. (NYSE:GGG) has declared a regular quarterly dividend of 29.5 cents ($0.295) per common share, payable on May 6, 2026, to shareholders of record at the close of business on April 13, 2026. The Company has approximately 165.6 million shares outstanding. ABOUT GRACO Graco Inc. supplies technology and expertise for the management of fluids and coatings in both industrial and commercial applications. It designs, manufactures and mark.

Graco just paid investors $0.295 per share on February 4, 2026, marking the company's 27th consecutive year of quarterly dividend payments.

Nuance Investments LLC trimmed its stake in Graco Inc. (NYSE: GGG) by 24.7% during the third quarter, according to its most recent disclosure with the SEC. The fund owned 65,986 shares of the industrial products company's stock after selling 21,673 shares during the quarter. Nuance Investments LLC's holdings in Graco were worth $5,606,000

Newell Brands is cutting prices by up to 15% at its Rubbermaid food storage brand and on several core items in baby-care portfolio Graco, a spokesperson told Reuters on Friday.

Graco Inc. (NYSE: GGG - Get Free Report) Director J Kevin Gilligan sold 12,870 shares of the company's stock in a transaction that occurred on Tuesday, February 3rd. The stock was sold at an average price of $89.07, for a total value of $1,146,330.90. The transaction was disclosed in a document filed with the SEC, which

From a technical perspective, Graco Inc. (GGG) is looking like an interesting pick, as it just reached a key level of support. GGG's 50-day simple moving average crossed above its 200-day simple moving average, which is known as a "golden cross" in the trading world.

AE Wealth Management LLC grew its position in Graco Inc. (NYSE: GGG) by 17.4% during the undefined quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 300,195 shares of the industrial products company's stock after purchasing an additional 44,418 shares during the quarter. AE