The iPSC-derived NK cells clinical trial analysis report delivers important insights into ongoing research of 15+ pipeline iPSC-derived NK cells drugs, clinical strategies, upcoming therapeutics, and commercial analysis. The iPSC-derived NK cells clinical trial analysis report delivers important insights into ongoing research of 15+ pipeline iPSC-derived NK cells drugs, clinical strategies, upcoming therapeutics, and commercial analysis.

SAN DIEGO, Feb. 03, 2026 (GLOBE NEWSWIRE) -- Fate Therapeutics, Inc. (NASDAQ: FATE), a clinical-stage biopharmaceutical company dedicated to bringing a first-in-class pipeline of induced pluripotent stem cell (iPSC)-derived cellular immunotherapies to patients with cancer and autoimmune diseases, today announced that on February 1, 2026, the Company granted to one newly-hired non-executive employee (i) non-qualified stock options to purchase a total of 120,000 shares of the Company's common stock at an exercise price per share of $1.19, which was the closing price per share of the Company's common stock as reported by NASDAQ on January 30, 2026, and (ii) restricted stock units (RSUs) representing 90,000 shares of its common stock. The grants were approved by the Compensation Committee of the Company's Board of Directors and granted under the Company's Amended and Restated Inducement Equity Plan as an inducement material to the new employee entering into employment with the Company in accordance with Nasdaq Listing Rule 5635(c)(4). The options will vest over four years, with 25% of the shares underlying the option vesting on the one-year anniversary of the grant date and the remaining 75% vesting in approximately equal monthly installments over the following thirty-six months, subject to the employee being continuously employed by the Company through each vesting date. The RSUs will vest over four years, with 25% of the shares underlying each RSU award vesting on each anniversary of the grant date, subject to the employee being continuously employed by the Company through each vesting date.

Shares of Fate Therapeutics, Inc. (NASDAQ: FATE - Get Free Report) have received a consensus recommendation of "Hold" from the nine analysts that are covering the firm, Marketbeat.com reports. One analyst has rated the stock with a sell recommendation, five have given a hold recommendation and three have issued a buy recommendation on the company. The

Fate Therapeutics, Inc. (NASDAQ: FATE - Get Free Report) insider Cindy Tahl sold 10,589 shares of the firm's stock in a transaction dated Friday, January 9th. The shares were sold at an average price of $1.06, for a total transaction of $11,224.34. Following the completion of the transaction, the insider directly owned 387,081 shares in the

Shares of Fate Therapeutics, Inc. (NASDAQ: FATE - Get Free Report) have received a consensus recommendation of "Hold" from the nine ratings firms that are currently covering the firm, Marketbeat Ratings reports. One analyst has rated the stock with a sell recommendation, five have given a hold recommendation and three have assigned a buy recommendation to

SAN DIEGO, Jan. 05, 2026 (GLOBE NEWSWIRE) -- Fate Therapeutics, Inc. (NASDAQ: FATE), a clinical-stage biopharmaceutical company dedicated to bringing a first-in-class pipeline of induced pluripotent stem cell (iPSC)-derived cellular immunotherapies to patients with cancer and autoimmune diseases, today announced that on January 1, 2026, the Company granted (i) non-qualified stock options to one newly-hired non-executive employee to purchase a total of 48,000 shares of the Company's common stock at an exercise price per share of $0.98, which was the closing price per share of the Company's common stock as reported by NASDAQ on December 31, 2025, and (ii) restricted stock units (RSUs) representing 79,400 shares of its common stock to four newly-hired non-executive employees, including the newly-hired employee receiving the non-qualified stock options referenced above. The grants were approved by the Compensation Committee of the Company's Board of Directors and granted under the Company's Amended and Restated Inducement Equity Plan as an inducement material to the new employees entering into employment with the Company in accordance with Nasdaq Listing Rule 5635(c)(4). The options will vest over four years, with 25% of the shares underlying the option vesting on the one-year anniversary of the grant date and the remaining 75% vesting in approximately equal monthly installments over the following thirty-six months, subject to the employee being continuously employed by the Company through each vesting date. The RSUs will vest over four years, with 25% of the shares underlying each RSU award vesting on each anniversary of the grant date, subject to the employees being continuously employed by the Company through each vesting date.

Fate Therapeutics, Inc. (NASDAQ: FATE - Get Free Report) shares crossed below its 200-day moving average during trading on Tuesday. The stock has a 200-day moving average of $1.16 and traded as low as $0.9510. Fate Therapeutics shares last traded at $0.9768, with a volume of 3,583,512 shares changing hands. Analyst Upgrades and Downgrades A

SAN DIEGO, Nov. 25, 2025 (GLOBE NEWSWIRE) -- Fate Therapeutics, Inc. (the “Company” or “Fate Therapeutics”) (NASDAQ: FATE), a clinical-stage biopharmaceutical company dedicated to bringing a first-in-class pipeline of induced pluripotent stem cell (iPSC)-derived cellular immunotherapies to patients with cancer and autoimmune diseases, today announced that the Company will present at the Piper Sandler 37th Annual Healthcare Conference on Tuesday, December 2, 2025 in New York, New York. Company management will participate in a fireside chat at 9:00 AM ET and a cell therapy panel discussion at 12:00 PM ET.

Shares of Fate Therapeutics, Inc. (NASDAQ: FATE - Get Free Report) have been assigned a consensus rating of "Hold" from the nine brokerages that are presently covering the firm, Marketbeat.com reports. One equities research analyst has rated the stock with a sell rating, five have issued a hold rating and three have assigned a buy rating

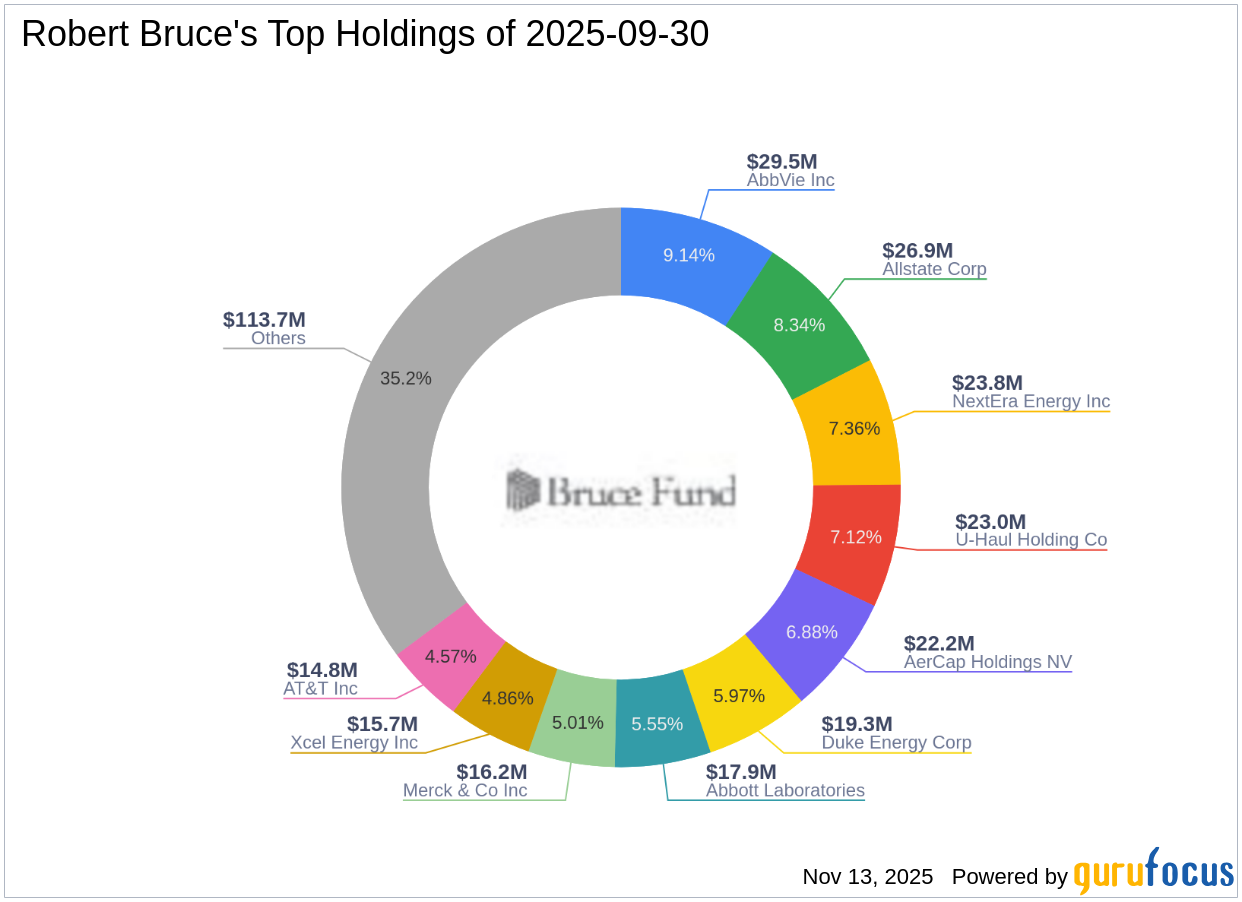

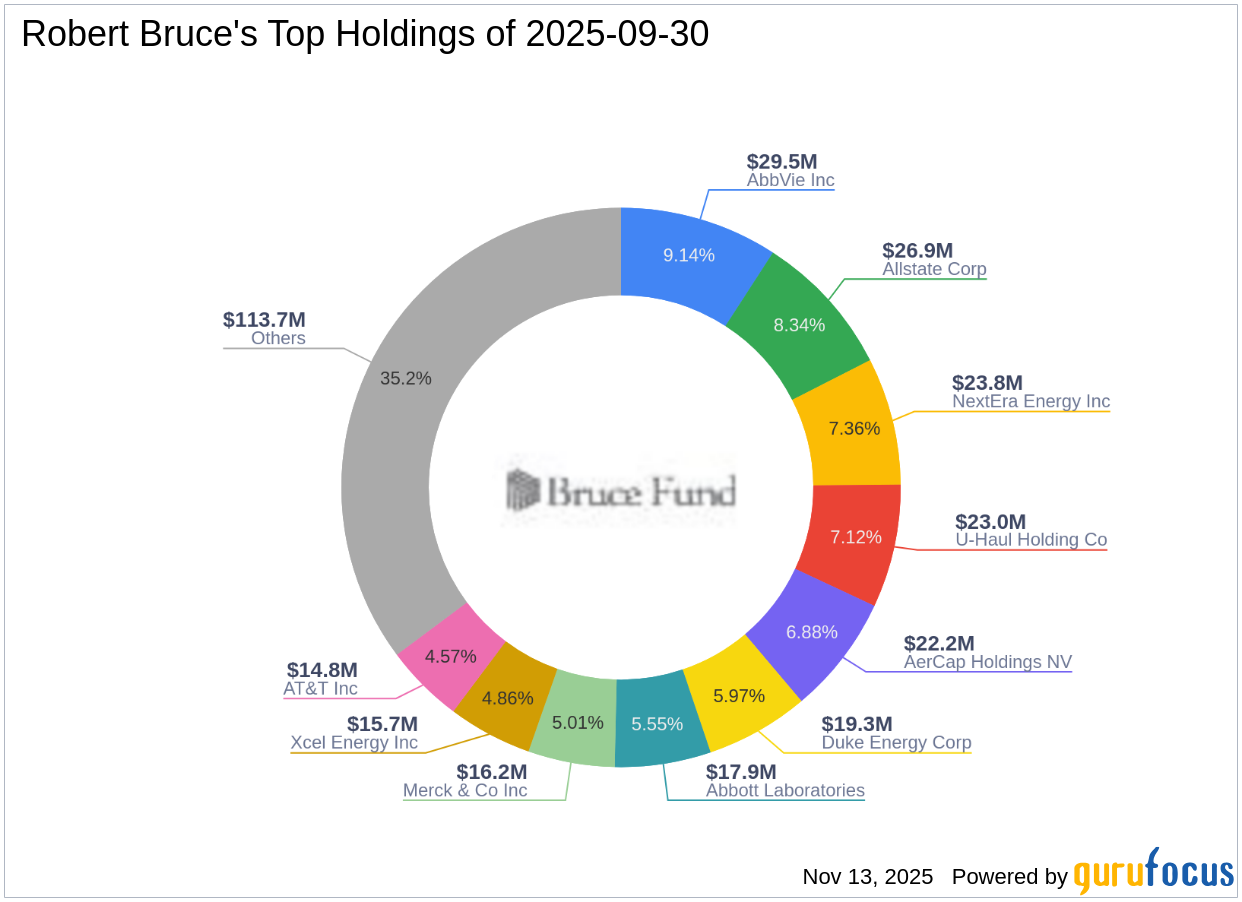

Insightful Analysis of Robert Bruce (Trades, Portfolio)'s Third Quarter 2025 13F Filing Robert Bruce (Trades, Portfolio) recently submitted the 13F filing for