Pre-Market Stock Futures: Futures are trading lower as investors and traders return from the three-day holiday break, after a wild week that saw just about everything. The catalyst on Friday was that the January consumer price index data came in below estimates at 2.4%. While anyone buying beef recently would dispute that inflation is lower,... Here Are Tuesday's Top Wall Street Analyst Research Calls: Albemarle, BitGo Holdings, Chevron, Dollar General, Equifax, Shopify, Southwest Airlines, Visa, and More.

Black Creek Investment Management acquired 502,120 shares in Eagle Materials during the fourth quarter. The quarter-end position value increased by $103.78 million due to the new share purchase.

Cresud Sociedad Anónima, Comercial, Inmobiliaria, Financiera y Agropecuaria WT EXP 030926 (CRESW) Q2 2026 Earnings Call Transcript

DALLAS--(BUSINESS WIRE)--The Board of Directors of Eagle Materials Inc. (NYSE: EXP) has declared a quarterly cash dividend of $0.25 per share, payable on April 13, 2026, to stockholders of record of its Common Stock at the close of business on March 16, 2026. About Eagle Materials Inc. Eagle Materials Inc. is a leading U.S. manufacturer of heavy construction products and light building materials. Eagle's primary products, Portland Cement and Gypsum Wallboard, are essential for building, expandi.

Timken remains a compelling investment as it supplies essential components that customers cannot easily replace. MDU remains an attractive investment as electricity demand continues to rise, particularly from energy-intensive industries such as data centers locating in the central United States. During the quarter, Raymond James' shares declined by 7.0% despite adjusted earnings exceeding consensus expectations by 10%, reflecting investor focus on near-term margin pressure rather than underlying business momentum.

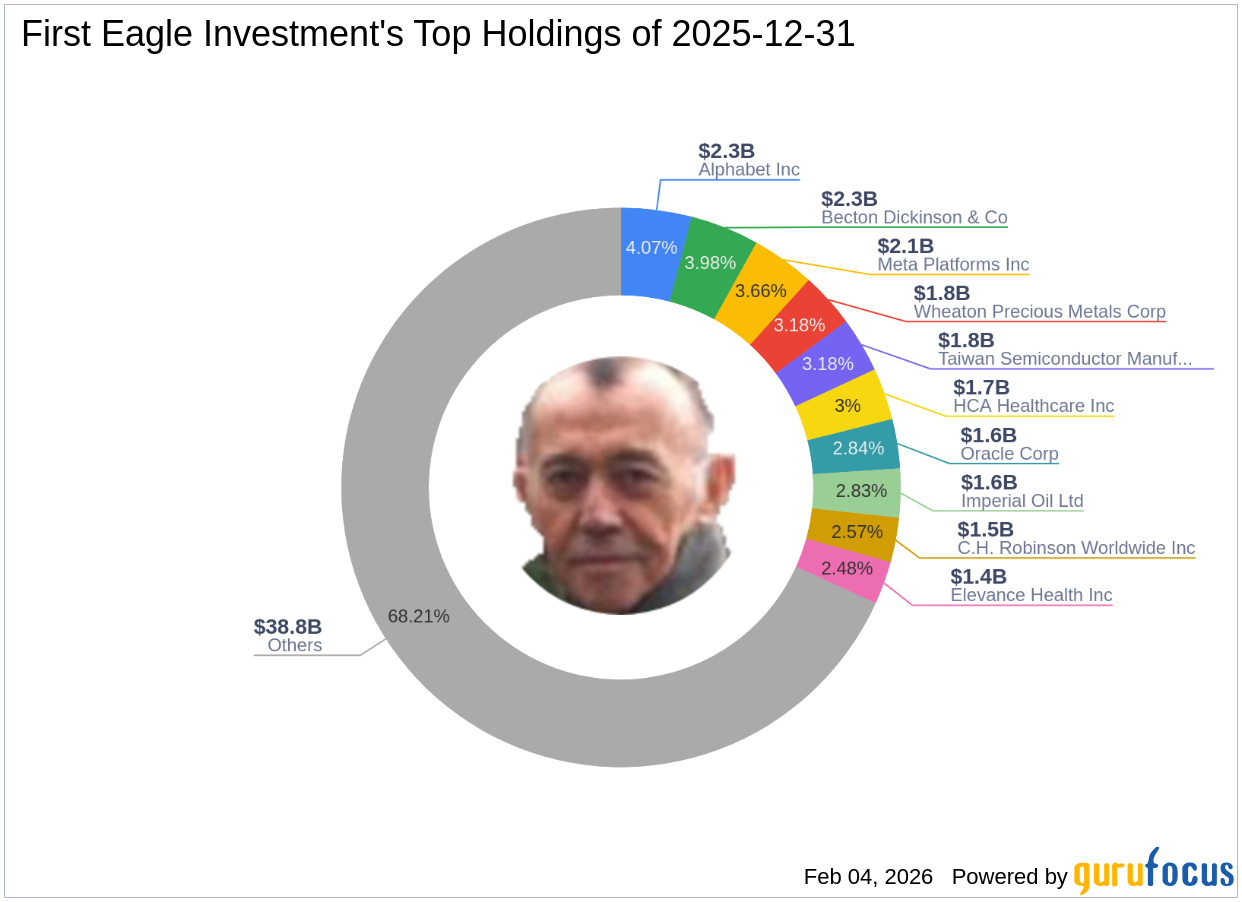

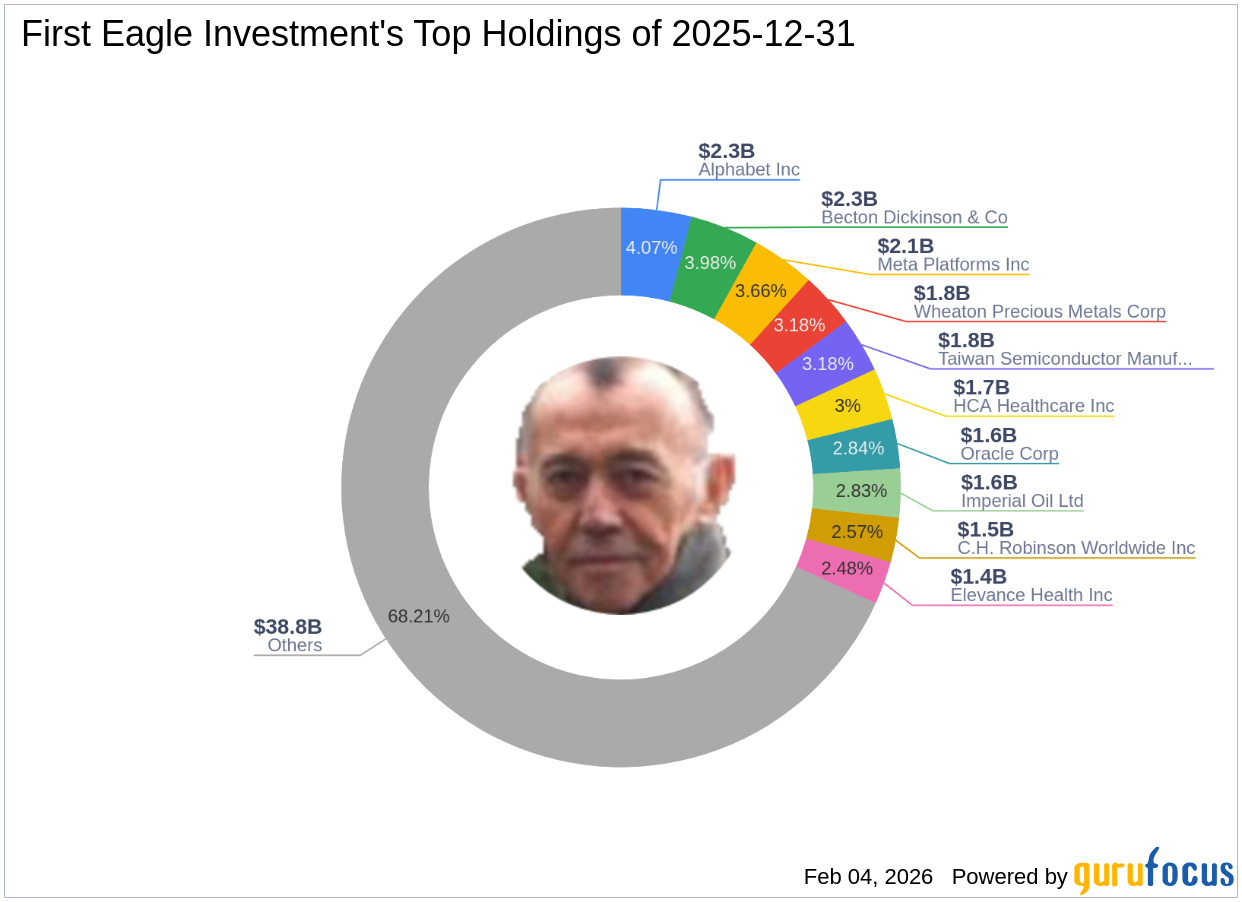

First Eagle Investment (Trades, Portfolio)'s Strategic Moves in Q4 2025 First Eagle Investment (Trades, Portfolio) recently submitted its 13F filing for the fo

Eagle Materials Inc. reported flat Q3 '26 revenue and missed EPS, with heavy materials strength offset by wallboard weakness. EXP maintains a solid balance sheet, low leverage, and active buybacks, but elevated capex is directed toward major growth projects. Heavy materials benefit from infrastructure and nonresidential demand, while wallboard faces ongoing residential headwinds and pricing pressure.

TORONTO, Feb. 03, 2026 (GLOBE NEWSWIRE) -- Electra Battery Materials Corporation (NASDAQ: ELBM; TSX-V: ELBM) (“Electra” or the “Company”) has awarded a US$6.1 million (C$8.3 million) contract to EXP Services Inc. ("EXP") to provide engineering, project management, and construction management services during the construction phase of Electra's Ontario battery materials refinery project.

Principal Financial Group Inc. raised its position in Eagle Materials Inc (NYSE: EXP) by 14.6% in the undefined quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 511,372 shares of the construction company's stock after acquiring an additional 65,072 shares during the quarter.

In the fourth quarter of 2025, the Harbor Mid Cap Value ETF returned 2.00% (NAV), outperforming its benchmark, the Russell Midcap® Value Index. We added Eagle Materials to the portfolio during the quarter, a U.S.-focused manufacturer of essential construction materials, including cement, wallboard, and aggregates. We sold Sealed Air Corporation during the quarter due to crowding out, a packaging solutions company providing protective, food, and specialty packaging products.