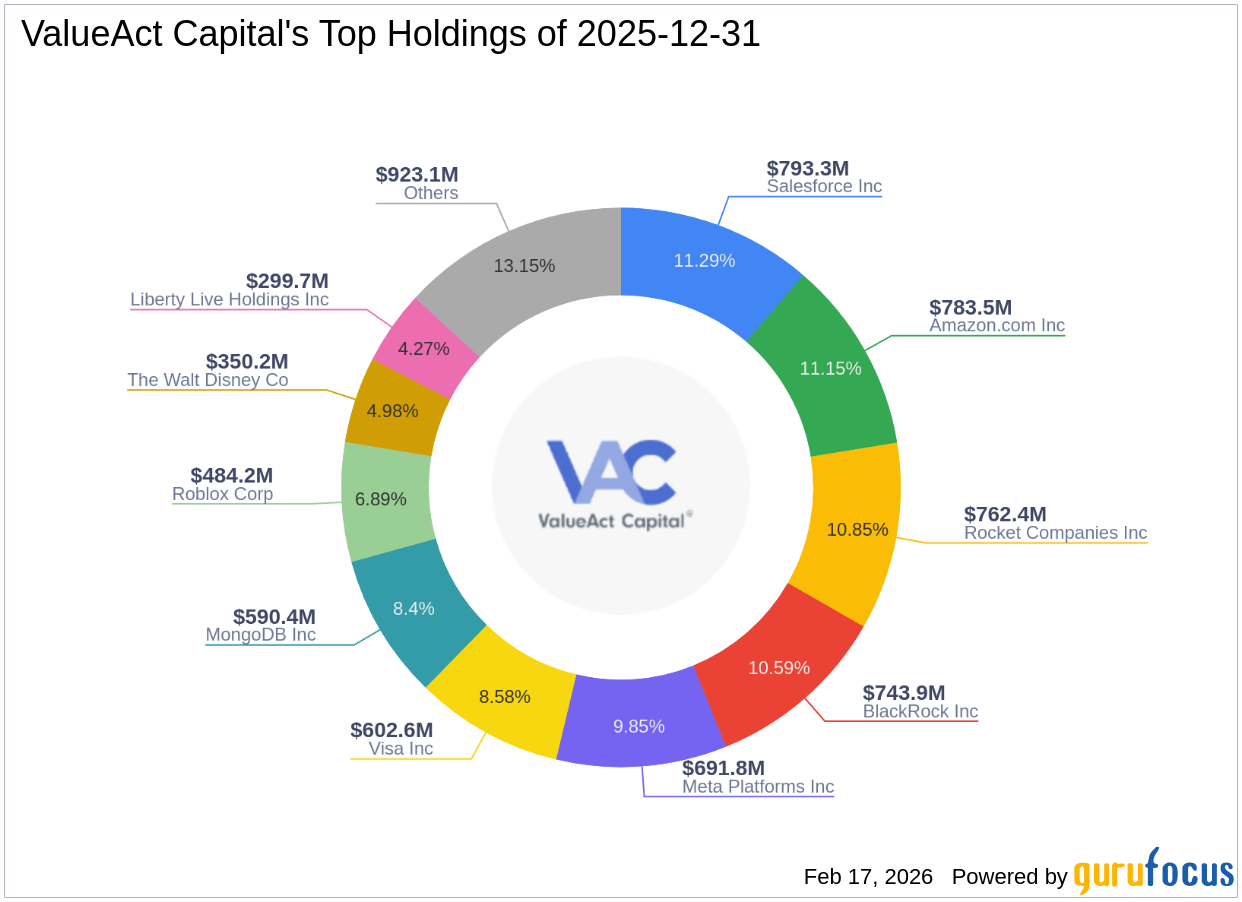

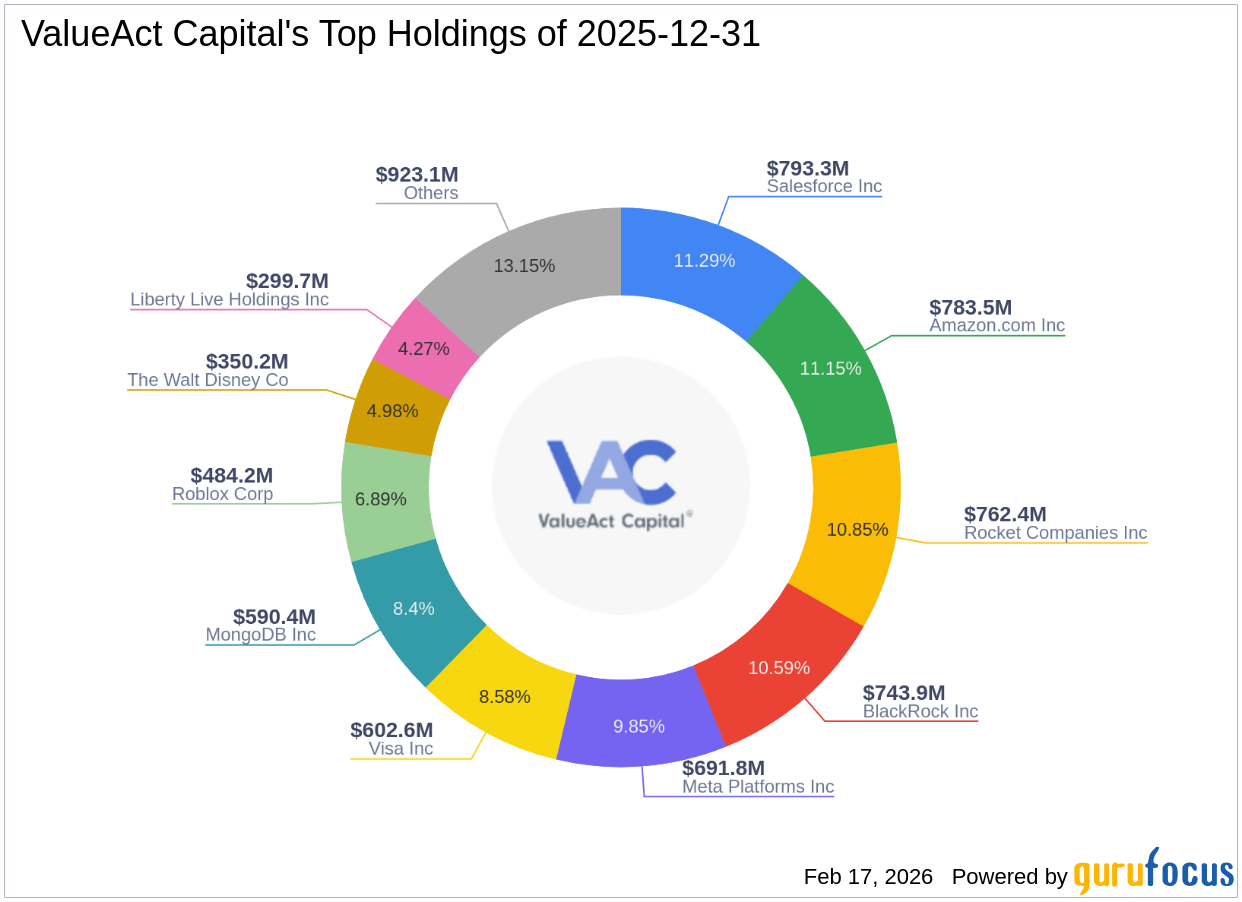

ValueAct Capital (Trades, Portfolio)'s Fourth Quarter 2025 13F Filing: Key Insights and Strategic Moves ValueAct Capital (Trades, Portfolio) recently submitted

| Quartal / Datum | EPS () | Schätzung () | Abweichung |

|---|

| Quartal / Datum | Umsatz (Mio ) | Schätzung (Mio ) | Abweichung |

|---|