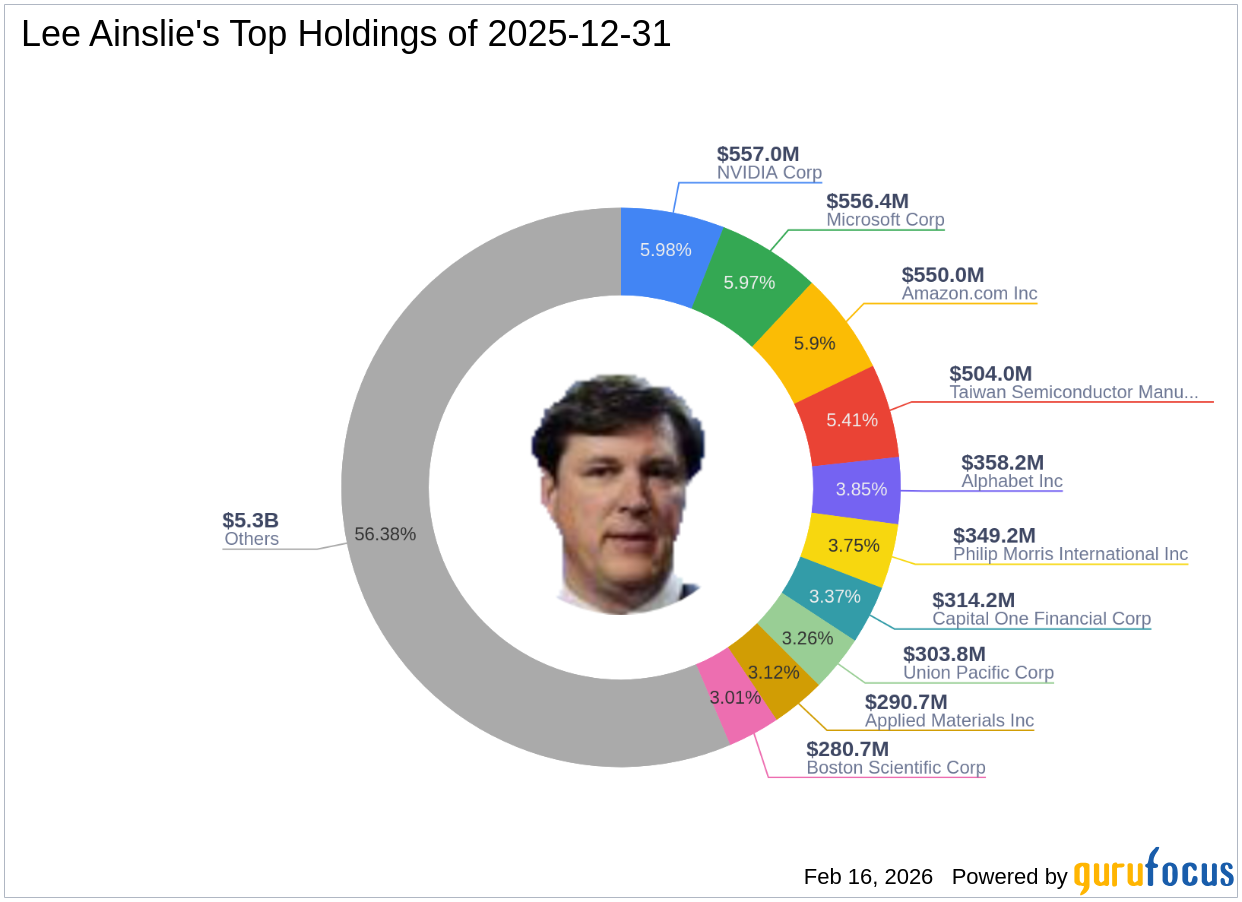

Abbott edges out Boston Scientific in the MedTech faceoff, with valuation appeal, strong CGM momentum and strategic deals boosting its investment case.

| Quartal / Datum | EPS (USD) | Schätzung (USD) | Abweichung |

|---|

| Quartal / Datum | Umsatz (Mio USD) | Schätzung (Mio USD) | Abweichung |

|---|