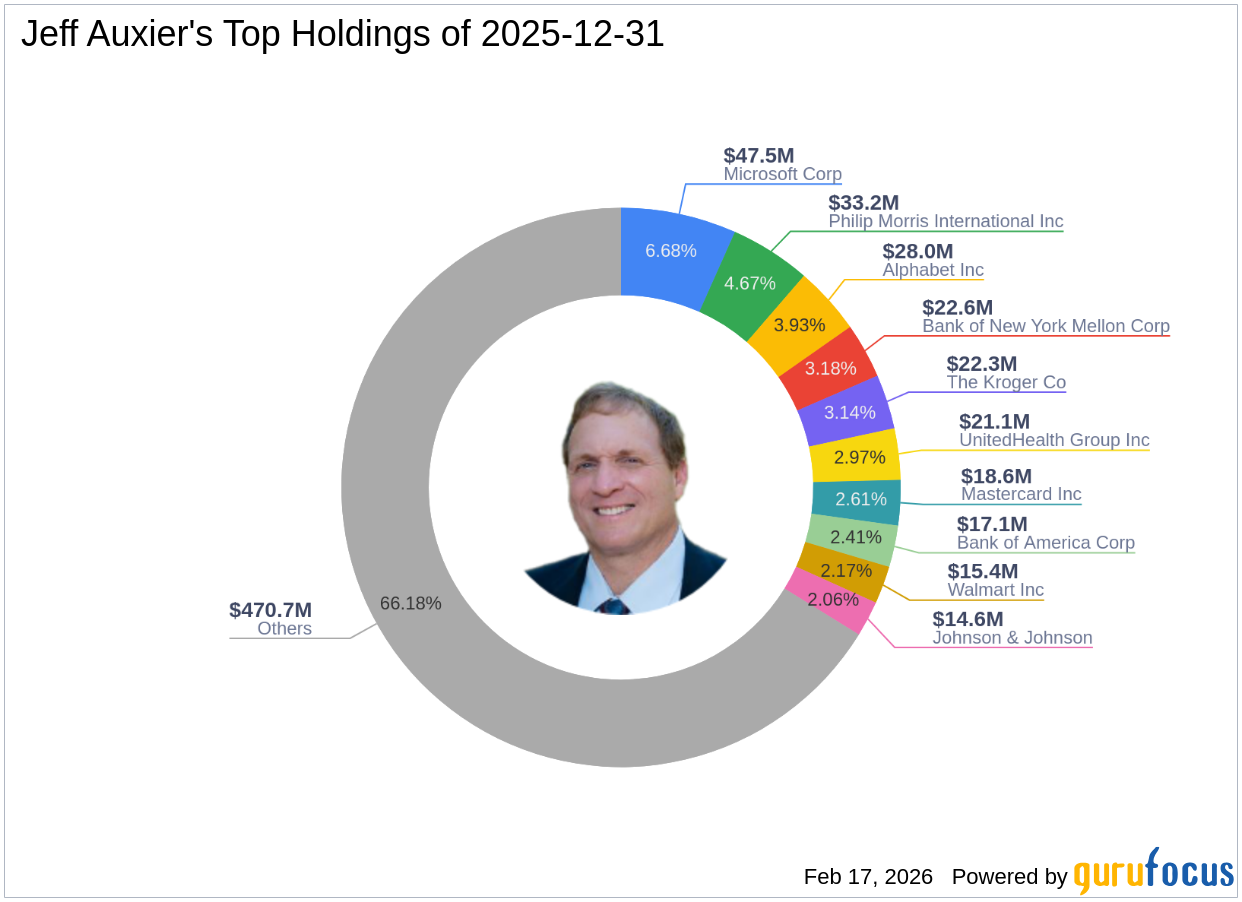

Empirical Financial Services LLC d.b.a. Empirical Wealth Management raised its holdings in shares of The Bank of New York Mellon Corporation (NYSE: BK) by 17.3% during the undefined quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 155,519 shares of the bank's stock after acquiring