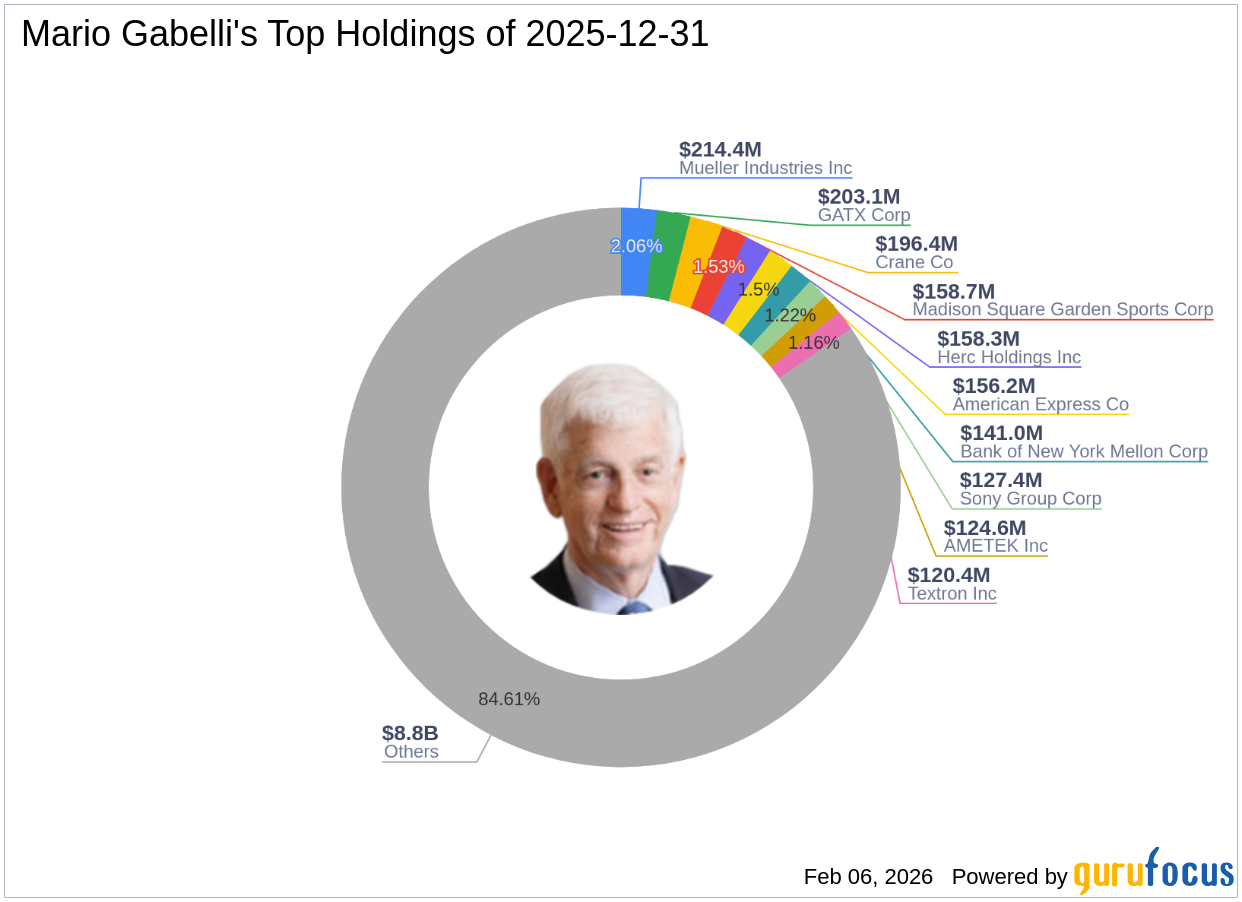

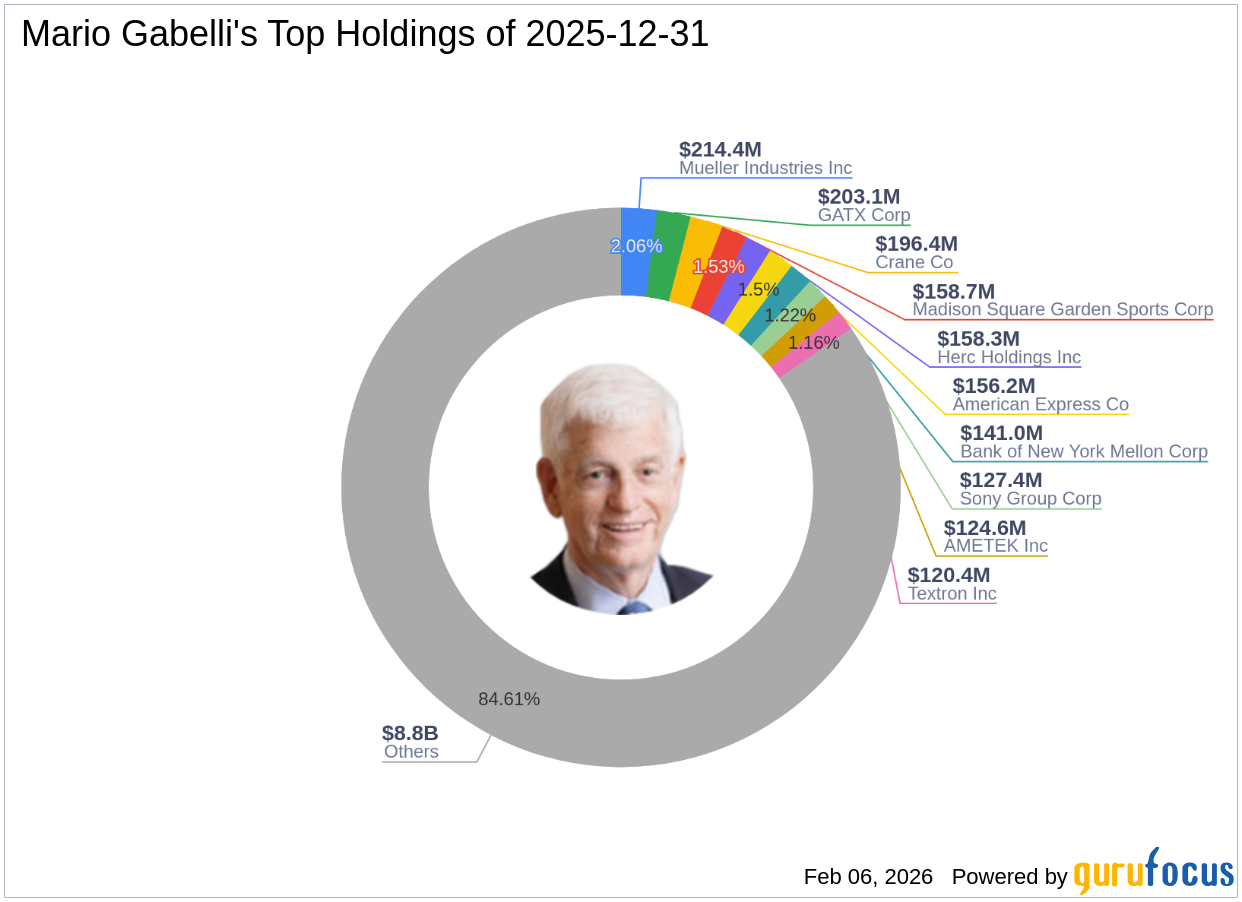

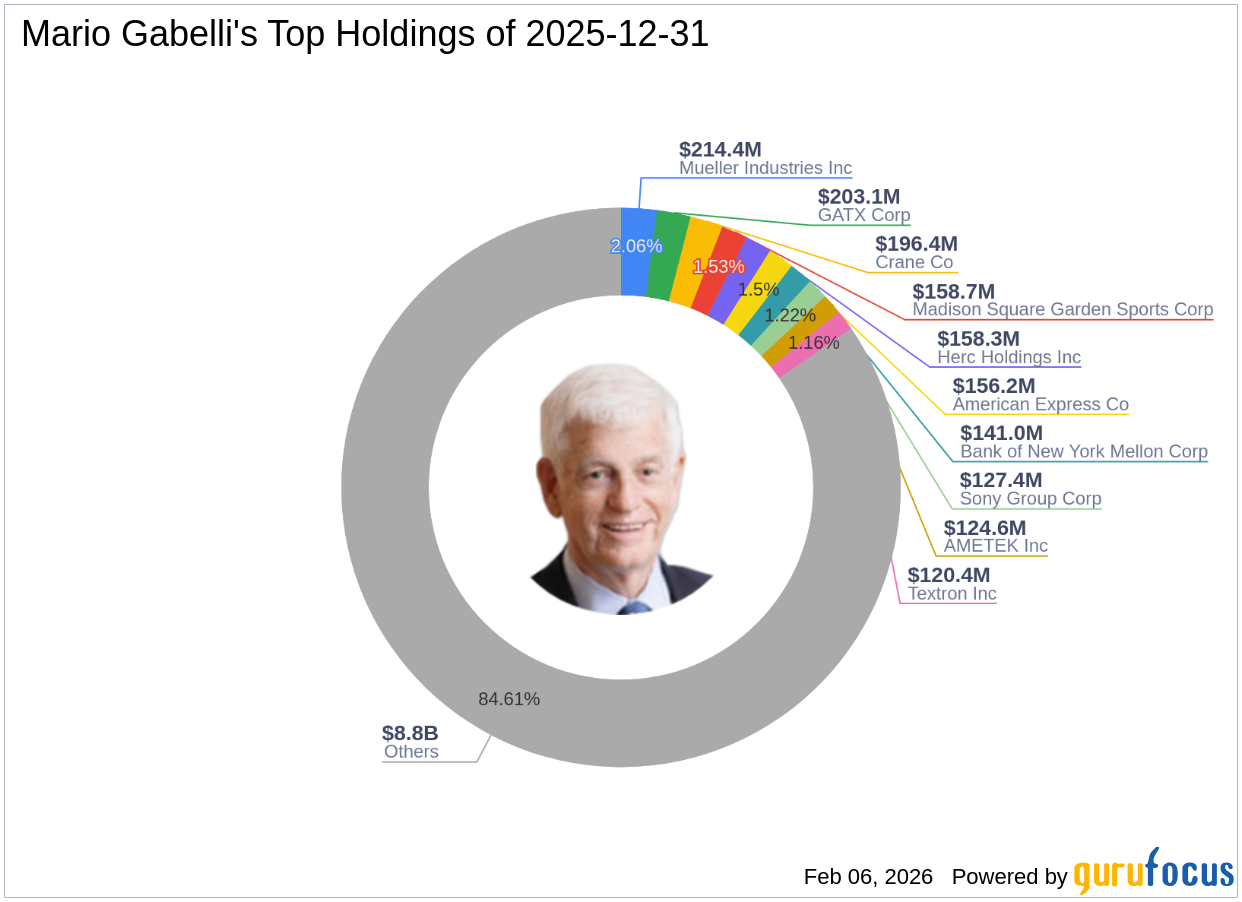

Insights into Mario Gabelli (Trades, Portfolio)'s Investment Moves in Q4 2025 Mario Gabelli (Trades, Portfolio) recently submitted the 13F filing for the fourt

Calgary, Alberta--(Newsfile Corp. - February 4, 2026) - Alpha Exploration Ltd. (TSXV: ALEX) ("Alpha" or the "Company") is pleased to announce recently received drilling results from an additional 1,460 metres of drilling from the 2025 exploration program at the Aburna Gold Project, within its 100% owned, 514km² Kerkasha Project located in Eritrea.

REITs are positioned for robust growth in 2026, driven by decelerating supply, disciplined capital allocation, and significant valuation discounts to NAV and private markets. Sector preferences favor Healthcare and Data Centers for durable growth, with Shopping Centers and select Residential REITs offering underappreciated upside and private capital interest. Strategic alternatives, buybacks, and targeted M&A are increasingly in focus, especially for deeply discounted names like CSR, WSR, COLD, and REXR.

Key Themes To Watch This REIT Earnings Season

NEW YORK CITY & NEW ORLEANS--(BUSINESS WIRE)--Former Attorney General of Louisiana Charles C. Foti, Jr., Esq. and the law firm of Kahn Swick & Foti, LLC (“KSF”) are investigating the proposed sale of Alexander & Baldwin, Inc. (NYSE: ALEX) to MW Group and funds affiliated with Blackstone Real Estate and DivcoWest. Under the terms of the proposed transaction, shareholders of Alexander will receive $21.20 in cash for each share of Alexander that they own. KSF is seeking to determine whethe.

SAN DIEGO, Jan. 23, 2026 (GLOBE NEWSWIRE) -- Shareholder rights law firm Johnson Fistel, PLLP has launched an investigation into whether the board members of Alexander & Baldwin, Inc. (NYSE: ALEX) breached their fiduciary duties in connection with the proposed sale of the company to MW Group, Blackstone Real Estate, and DivcoWest.

Heartland Value Fund Q4 2025 Attribution Analysis & Portfolio Activity

HONOLULU, Jan. 15, 2026 /PRNewswire/ -- Alexander & Baldwin, Inc. (NYSE: ALEX) ("A&B" or "Company"), a Hawai'i-based company focused on owning, operating, and developing high-quality commercial real estate in Hawai'i, today announced the allocations of the Company's 2025 dividend distributions to its common shares. The table below, presented on a per share basis, is provided for information purposes only and should only be used to clarify the information on Form 1099-DIV.

The REIT sector closed out 2025 with a tough December (-1.48%) and finishing the year with a -3.57% total return for 2025. Small caps (+0.51%) eked out a small gain in December, while mid caps (-1.77%), large caps (-2.55%) and micro caps (-3.88%) fell at the close of the year. 42.04% of REIT securities had a positive total return in December with only 38.36% in the black for the full year.

REITs (MSCI US REIT Index, RMZ) are positioned for multi-year outperformance, with accelerating AFFO growth, healthy balance sheets, and discounted valuations. Despite underperformance versus the S&P 500, REITs offer a credible path to 13-15% annualized total returns via multiple expansion and a 4% dividend yield. Wide NAV discounts create near-term catalysts, as managements deploy asset sales, cost controls, and strategic alternatives to close valuation gaps.